INDUSTRIES

Manage your assets with our aviation lease management software

Nomos One delivers a leading aviation lease management software that can help you achieve IFRS 16 compliance, streamline the transition and reporting process, and is trusted by chartered accountants and auditors internationally.

Nomos One’s lease management and accounting software assists your accounting and property management teams in managing large and complex leasing portfolios. Aircraft leasing, aeronautical and terminal side leases and other agreements can be a complex part of your aviation business. Vigilant portfolio management is critical when it comes to making informed decisions around your operational business needs. Investing in aviation lease management software and lease accounting software can help your business streamline and better manage lease portfolios.

The challenges of lease accounting in aviation

In addition to the regular challenges of lease management, aviation businesses are faced with the challenges of IFRS 16. IFRS 16 will directly impact the financial performance and value of your company. It is essential to adhere to the IFRS 16 standards in your business and aviation operations.

Given the complexity of lease accounting under IFRS 16, we recommend aviation businesses invest in a lease management and lease accounting platform that can help you achieve IFRS 16 compliance. Our aviation lease management software will ensure that your lease portfolio is up to date with easily actionable notifications that help you meet protocol milestones with confidence.

Lease management designed for aviation

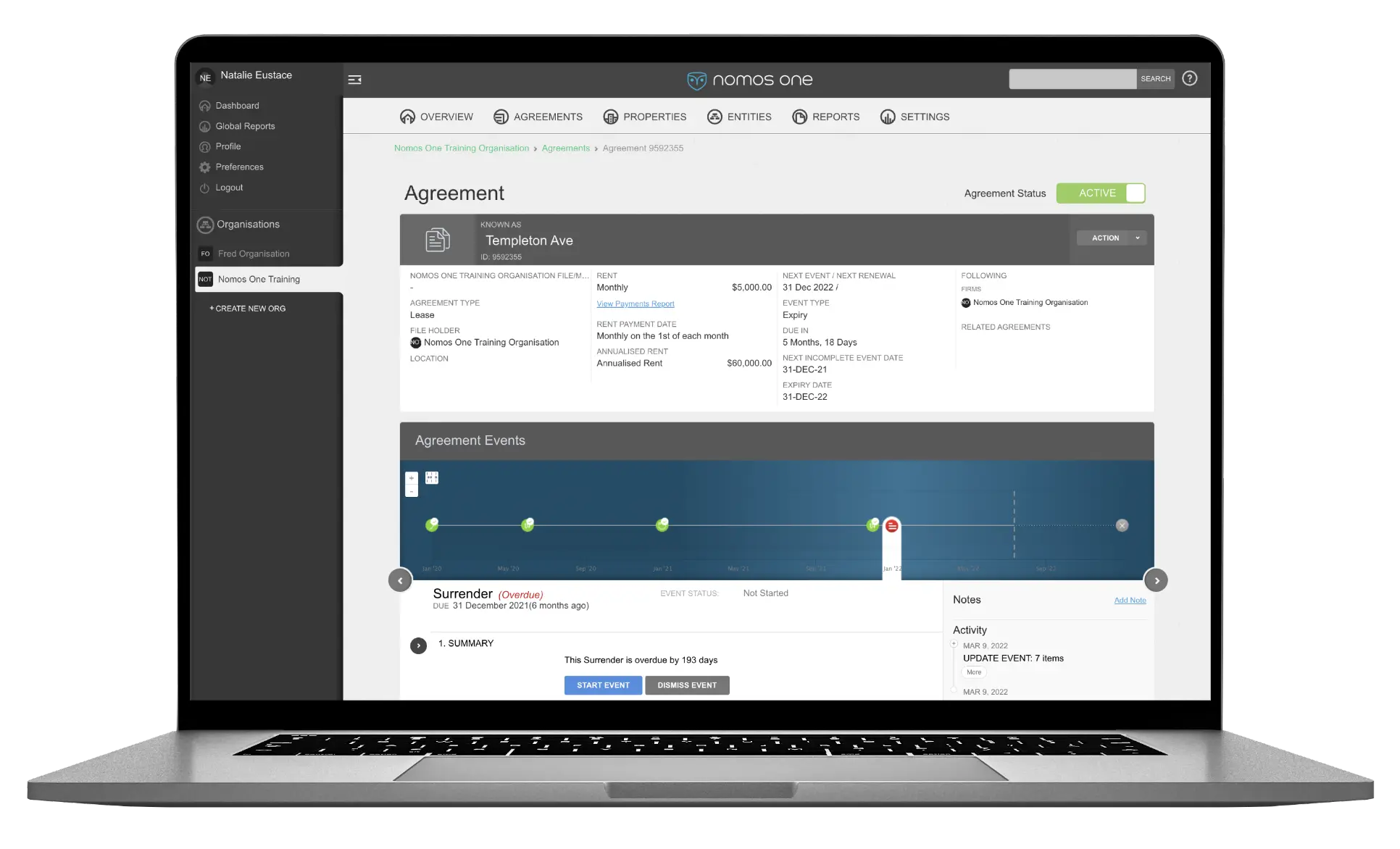

Nomos One is a comprehensive, cloud-based, lease management and lease accounting software solution, designed to accommodate a large range of aviation leased assets. This is the lease accounting and management software your business needs to ensure the efficient management of leases, subleases, licences, sublicences, easements, grants, resource consents and general contracts.

Nomos One offers a number of benefits that will save your business time and effort. Our lease accounting software offers advantageous features for many businesses, including automated calculations, a coherent and straightforward dashboard, event reminders, a user-friendly workflow, and custom reports and fields. Our robustly tested IFRS 16 modules automatically calculate right-of-use assets, lease liabilities, depreciation and interest expenses, and generate the resulting journals accordingly.

Questions? We’ll put you on the right path.

FAQs

What is lease accounting?

Lease accounting is the recognition of the transactions and balances associated with lease contracts and events for a business’ financial reporting. Both lessors and lessees are required to account for lease transactions, though each in different ways. With the introduction of IFRS 16 (AASB 16), lessees are required to recognise a lease liability and a right-of-use asset, while little has changed for lessors, who continue to differentiate between operating and finance leases.

What is lease accounting software?

Lease accounting software is a tool that empowers enterprises to manage their lease portfolio more effectively. Lease accounting software is designed to centralise information and effectively automate previously manual administrative tasks. Lease accounting software assists businesses in managing their lease and accounting regulations.

The software eliminates the requirement for paper trails, and most quality software will set reminders for the business’ upcoming financial milestones to ensure that critical dates are never overlooked.

What is IFRS 16?

Under IFRS 16, aviation businesses are required to recognise a lease liability for the future expected lease payments as well as a corresponding asset that represents their right to use the leased asset.

The lease liability is based on the present value of the future fixed and in substance fixed lease payments. The liability is an amortising liability whereby interest is accrued and expensed over the life of the lease.

The right-of-use asset is equal to the lease liability at the beginning of the lease liability calculations (subject to any prepayments, initial direct costs incurred, and estimated restoration obligations) and is depreciated systematically over its useful life.

Who needs lease accounting software?

Essentially, lease accounting software is designed to meet the needs of finance teams, accountants, auditors and property managers. Nomos One’s solution is perfect for those working in the aviation sector.

Lease accounting software solutions may be necessary for anyone who has to manage leasing activities, the financial impacts of leasing, and comply with lease accounting standards. This includes property investors, tenants, lessors, real estate agents, small business owners and accountants.

Both tenants and the lessor can utilise lease accounting software to manage all types of real estate assets. Quality, reliable and advanced lease accounting software has become crucial in recent times for both lessees and lessors to assist towards compliance with ever-evolving lease-specific accounting and depreciation standards.

What is the best lease accounting software?

The best lease accounting and lease management software will provide clients with access to the following features:

- Access to an asset portfolio in a centralised location

- A customised dashboard

- Tailored, consolidated reporting and fields

- Cloud-based location

- Automated calculations

- A simple dashboard

- An intuitive, user-friendly platform

- Event reminders and milestone notifications

- Coherent workflows

- Automation of administrative tasks

- Ongoing support for new users

Nomos One provides aviation businesses with these attributes and more. Our aviation lease management and lease accounting software features a user-friendly workflow, with a coherent straightforward dashboard and centralised access to lease information. Nomos One automates administrative and time-consuming tasks such as calculation, event reminders and the generation of lease documents. Furthermore, Nomos One provides custom reporting and field generation to ensure your analysis is relevant to the aviation sector.

How much does lease accounting and lease management software cost?

Lease accounting and management software can vary greatly in pricing. The experts at Nomos One recommend that all prospective software users investigate more than just the cost of the software before selecting the best program for your business. Cheap leasing software doesn’t always translate to quality software.

Good quality lease accounting and lease management software will be secure, dependable, and modern and support IFRS 16 reporting. Nomos One offers a reliable, sophisticated cloud-based software solution with hands-on onboarding experience and free ongoing support. Our plans are customised to the specific requirements of your business.

What is IFRS 16 in relation to the aviation sector?

IFRS 16 (or known as AASB 16) is an accounting standard that necessitates the recognition of assets and liabilities relating to the obligations detailed within a lease contract. IFRS 16 reports details of lease transactions and provides financial statements before acknowledging, assessing, reporting, and disclosing leases.

The mandatory application of IFRS 16 will have a direct impact on the financial performance of your aviation business. Since the mandatory introduction of IFRS 16, the aviation sector has experienced an increase in recognised assets and liabilities, more lease expenses recognised in earlier periods of a lease and less in later periods, a shift in lease expense classification and amortisation, and an increase in net debt/EBIT/EBITDA ratios.

It is critical that enterprises within the aviation sector adhere to the IFRS guidelines throughout aviation business operations.